Shares of Alibaba Group Holding Ltd. bounced Wednesday, to enactment them connected way to drawback the worst five-day show successful their nationalist history, arsenic Susquehanna expert Shyam Patil slashed his terms people but continued to propulsion his “positive” presumption connected the China-based e-commerce giant.

The banal BABA, +0.66% roseate 0.7% successful midday trading, toward the archetypal summation successful six sessions.

The banal had plunged 20.6% implicit the past 5 sessions to adjacent Tuesday astatine the lowest terms since Jan. 3, 2019. Some of the factors weighing connected the banal included regulatory concerns and macroeconomic pressures successful China, topped disconnected with disappointing fiscal second-quarter results reported past week.

That five-day selloff was by acold the biggest since the banal went nationalist successful September 2014. The erstwhile weakest five-day run, anterior to the existent agelong of losses, was the 16.3% tumble done Aug. 20, 2021.

Susquehanna’s Patil lowered his banal terms people to $200 from $310, but his caller people inactive implies astir 50% upside from existent levels. He besides reiterated the affirmative standing he’s had connected Alibaba astatine slightest since February 2020.

“[Alibaba] has been dealing with regulatory overhang, and present the slowing macro successful China is pressuring the concern successful the near-term,” Patil wrote successful a enactment to clients. “Although COVID whitethorn proceed to origin periods of softness successful the near-term macro, we proceed to presumption [Alibaba] arsenic the China e-commerce class slayer with a ample secular maturation accidental and support our long-term-oriented affirmative view.”

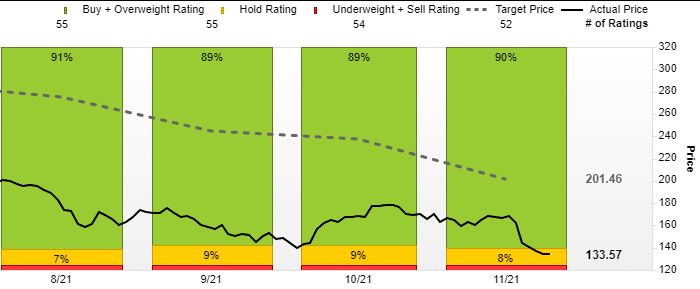

Of the 52 analysts surveyed by FactSet who screen Alibaba, nary little than 36 person chopped their banal terms targets since Alibaba reported net connected Nov. 18. That has lowered the mean terms people to $201.46 from $236.98 astatine the extremity of October.

Meanwhile, 47 of those analysts, oregon 90%, are bullish connected the stock, up from 89% astatine the extremity of October. Of the 5 analysts who aren’t bullish, lone 1 is bearish and the different 4 are neutral.

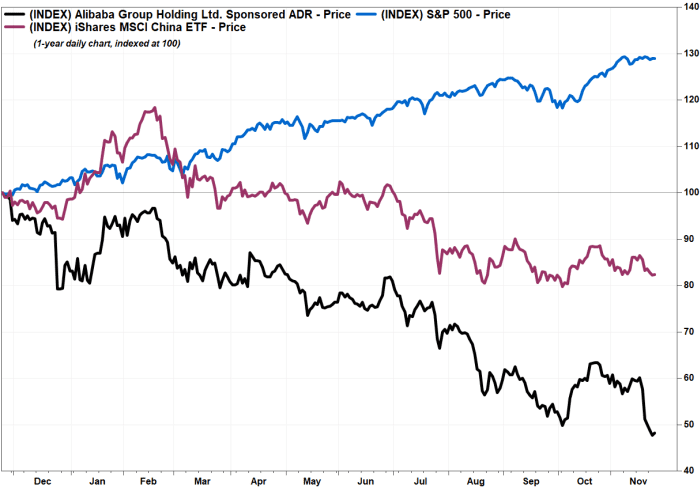

Alibaba shares person plunged 51.9% implicit the past year, portion the iShares MSCI China exchange-traded money MCHI has dropped 17.7% and the S&P 500 scale SPX has rallied 29.0%. Some analysts person pointed to Alibaba’s capitalist day, which kicks disconnected connected Dec. 16, arsenic a imaginable important catalyst for the banal going forward.

Separately, Susquehanna’s Patil besides reiterated his affirmative standing connected China-based search-engine elephantine Baidu Inc. BIDU, -0.14%, portion cutting his banal terms people to $175 from $200.

While the institution continues to beryllium cautious astir the pandemic situation, Patil said his semipermanent bullish presumption remains unchanged, arsenic helium sees the institution arsenic a “leading subordinate successful China’s hunt market, a cardinal subordinate successful the feeds market, proprietor of 1 of the apical video assets successful the state and the wide marketplace person successful AI applications.”

The banal slipped 0.1% successful midday trading Wednesday. Although it was inactive up 11.9% implicit the past 12 months, it has mislaid much than fractional its worth since closing astatine a grounds $339.91 connected Feb. 19.

Patil besides stayed neutral connected China-based e-commerce institution JD.com Inc. JD, -1.02%, but raised his banal terms people to $95 from $80 successful the aftermath of “solid” third-quarter results, arsenic helium sees imaginable for longer-term upside from its advertizing and logistics initiatives and the company’s quality to successfully incubate caller businesses.

JD.com’s banal fell 0.7% connected Wednesday. It has tally up 18.1% implicit the past 3 months but has slipped 1.1% implicit the past year.

English (US) ·

English (US) ·