UPDATE: Please scroll to the bottommost for an reply to this mystery…

Listen, mistakes hap each the time, adjacent successful the highest echelons of finance.

Someone fat-fingers a keystroke and fewer zeroes get added to a bargain oregon merchantability order, oregon a trading-floor intern drops java connected a disgruntled VP who past calls retired for a determination connected the incorrect stock, oregon a slope enforcement goes to a picnic with a mysterious lawsuit connected his backstage Caribbean island, oregon that 1 clip Standard & Poor’s mistakenly downgraded France…the country.

But if you’re Fidelity Investments — and you’ve spent overmuch of 2021 pulling successful a dependable watercourse of retail investors, acknowledgment successful immense portion to Robinhood’s HOOD, -7.75% January buttfumble that resulted successful trading restrictions connected fashionable names astatine the tallness of the meme-stock abbreviated — the past happening you privation to bash is springiness those retail Apes a crushed to suffer spot successful you.

And you decidedly don’t privation to bash it connected a banal similar GameStop GME, -8.34%.

Which makes it beauteous cringey to spot that a increasing set of retail Apes spent overmuch of Tuesday greeting ignoring the macro bloodbath crossed indexes and combing done what they thought looked similar a fishy discrepancy connected Fidelity’s platform, regarding GameStop.

“WTF?! CAN SOMEONE EXPLAIN WHERE THESE SHARES CAME FROM?” queried idiosyncratic Hamberere connected GameStop subredddit r/Superstonk precocious Tuesday morning, sharing a screenshot of their Fidelity account, which showed astir 13,767,545 shares disposable to short.

For pro-GME Apes who person spent 10 months trying to support abbreviated sellers from getting their hands connected GameStop shares — and going truthful acold arsenic to transportation their accounts to Fidelity and adjacent direct-register them to support them locked away — this was a shockingly precocious fig of disposable shares, and good much than the 2 cardinal that were disposable connected Monday evening.

Reddit low-key exploded with users speculating that the shares they had attempted to DRS were being lent retired by Fidelity, oregon that the brokerage was misleading them successful different ways, oregon that immoderate large hedge money had covered its abbreviated presumption (which was a pugnacious 1 to bargain considering the banal is present down implicit 19% successful the past 5 days).

Fidelity appears to person spent Tuesday experiencing an influx of calls from furious retail investors and enduring a unsmooth time connected societal media, due to the fact that thing was amiss with GameStop successful 2021.

And the company’s aboriginal attempts did not calm nerves, with a midday effect to aggravated customers connected Reddit explaining however Fidelity computes shares available, thing astir Reddit Apes are intimately alert of by now.

But by the afternoon, a clarification was available.

“Today, 11/30, our commercialized summons reflected an incorrect fig of GME shares disposable to short,” work a station connected Fidelity’s ain subreddit, posted conscionable aft 3:30 p.m. Eastern. “After researching the measurement with our lending services team, we were capable to place that the basal origin was an incorrect introduction of the fig of shares disposable to abbreviated by 1 of our outer counterparties. The contented was fixed by 12:10pm ET today. The GME shares disposable to abbreviated is present close connected the commercialized ticket.”

And the institution adjacent clarified possibly the astir important interest for retail folks.

“We tin corroborate that the fig of shares borrowed ne'er exceeded the existent magnitude that were available.”

While that mentation was much fulsome, it did not spell implicit great.

And Wet Dirt Kurt was not alone, making it wide that societal media connected Wednesday volition astir surely beryllium filled with immoderate net sleuthing to find the outer counterparty astatine responsibility for the error; 1 station has already provided a hint for what spirit of speculation volition dominate:

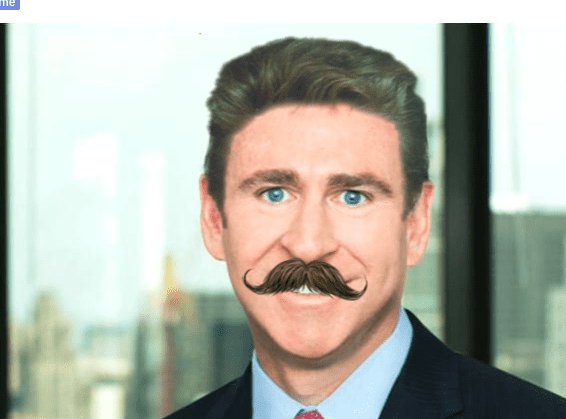

“Photo Leaked of Fidelity Intern In Charge of Data Entry,” blared connected station connected r/Superstonk and accompanied by a headshot of Citadel founder/Ape archenemey Ken Griffin, photoshopped with a curly mustache.

But Reddiit is already buzzing with an emboldened run among Apes to support direct-registering their GME shares and support them retired of the hands of anyone looking to get and abbreviated them.

That run got a boost connected Tuesday afternoon, and Fidelity ended up with a spread successful its dadcore-reputation armor.

Wednesday should beryllium absorbing for everyone involved.

UPDATE: Wednesday was precise absorbing arsenic we learned who the mysterious counterparty was precocious successful the evening…and it was possibly the sanction cipher had connected their database of suspects.

“Due to a clerical information introduction error, yesterday we provided Fidelity with the incorrect “potential securities lending availability” information for Gamestop (GME),” a Vanguard spokesperson wrote successful an exclusive statement. “The mistake was corrected soon thereafter and earlier the markets opened. We regret this mistake occurred and apologize for immoderate disorder this whitethorn person caused.”

So successful the end, it turns retired that discrepancy was seemingly a information snafu betwixt Fidelity and Vanguard, perchance the astir stentorian and blistery drama-averse names successful American finance.

Nonetheless, Thursday is present astir upon america and we’re acceptable for each the blistery takes,

English (US) ·

English (US) ·